Invest in the Future

Proactive

Investing

400+ CFDs on FX, Stocks, Commodities, Crypto, and Indices

- Advanced Trading Platforms

- Market News, Premium Trading Tools

- Dedicated, Multilingual Client Support

Available on Web, Mobile and MT4.

PROACTIVE INVESTING

400+ CFDs on FX, Stocks, Commodities, Crypto, and Indices

- Advanced Trading Platforms

- Market News, Premium Trading Tools

- Dedicated, Multilingual Client Support

Available on Web, Mobile and MT4

Superfast trade execution

At EZInvest, we’re committed to providing fast, quality executions with the highest level of transparency.

tight spreads

Our trading platform offers the largest selection of international currency pairs, all major indices, commodities, and CFD stocks on competitively tight spreads, helping you to lower your trading costs.

Hi-tech forex trading tools

Trade with confidence and benefit from our advanced tools and features for an excellent online trading experience.

Ultimate risk

protection & security

With EZInvest you can trade smarter and minimize your risks by using our innovative technology and resourceful educational platform.

About Us

Proven industry expertise

We work very hard to set the standard for professional trading in a crowded and relentless industry. We strongly believe that success relies on communication and the time we get to know our clients. At EZInvest, everything starts from the trading floor. We develop our services and products based on that first-hand knowledge that gives us a full understanding of what traders really need.

Open Account in

3 Simple Steps

01

REGISTER

Choose an account type and submit your application in just a few minutes.

02

FUND

Fund your account using a wide range of funding methods.

03

TRADE

Access 300+ instruments across all asset classes on desktop and mobile.

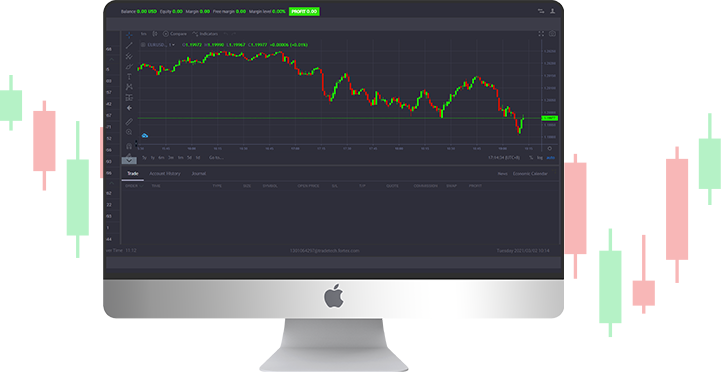

Trading Platforms

SIRIX and MT4 (Meta Trader 4)

Our trading platforms are accessible anywhere, anytime from any mobile or desktop device.

Webtrader sets the standard for browser-based trading platforms, providing advanced charting options and social trading.

The most trusted and popular platform for professional traders.

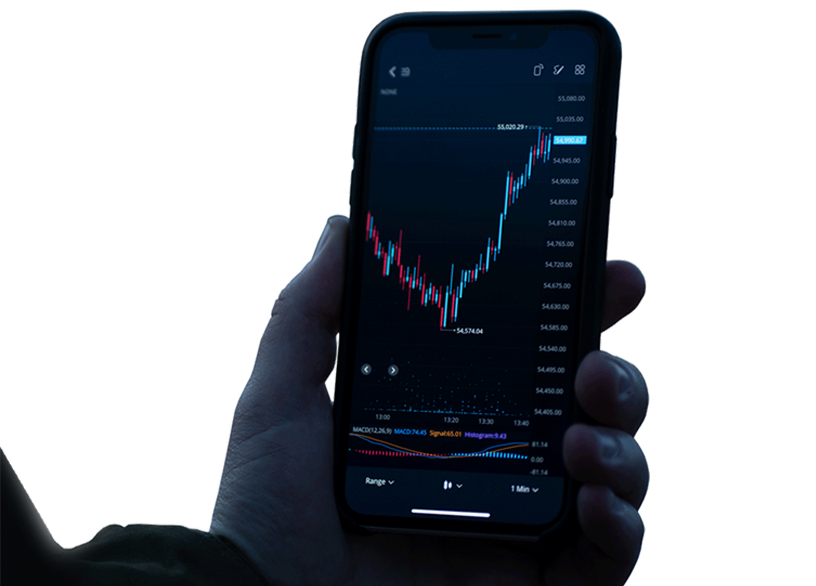

Trade On The Go

Mobile Trading

EZInvest Mobile is a fully-featured app for the trader on the go. With all of the charts and news that you’ll need to trade successfully, EZInvest Mobile offers an excellent trading experience and easier access to actively manage your portfolios, even when you are away from a desktop or laptop. The platform is compatible with Apple and Android devices. Enjoy & Experience one of the best mobile trading apps.